Silver: The Good, the Bad and the Ugly

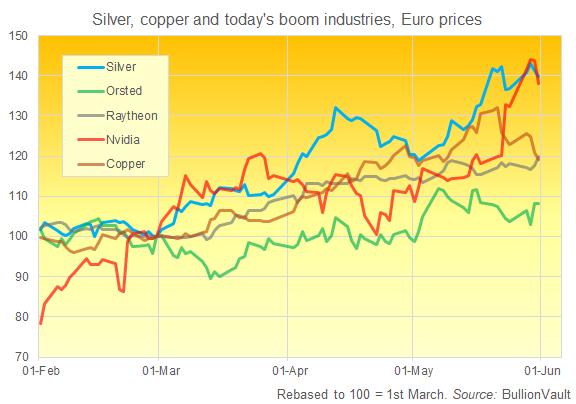

- Danish windpower giant Ørsted (CPH: ORSTED) gained a nice but unexciting 8% in Euro terms;

- US defence giant Raytheon (NYSE: RTX) leapt by nearly 20%, outpacing its rival Lockheed Martin (NYSE: LMT) three-fold;

- Nvidia (Nasdaq: NVDA) rose 38% as the world went gaga over the 'artificial intelligence' chipmaker's earnings and outlook.

Email us

Email us