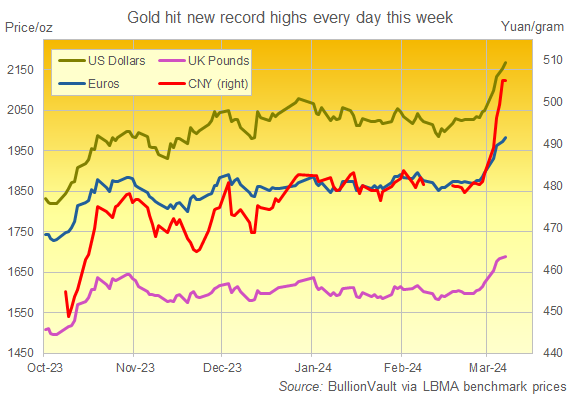

Blow-Off Top in Gold? Price Hits New Record High 5 Days Running

Western gold investment

Gold futures and options

Physical gold outside the West

Short-term gold price outlook

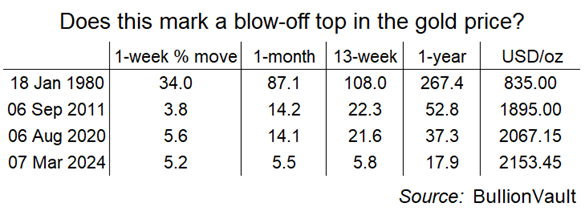

How unusual is this gold-price surge?

- Week-on-week 5.2%

- 1-month change 5.5%

- 13-week change 5.8%

- 1 year change 17.9%

Gold's previous runs of record-high prices

- 3 days running on 78 of all trading days (ie, some of them are included in longer runs)

- 4 days 33 times

- 5 days 15 times

- 6 days 4 times

- 7 days just once

Email us

Email us