Gold ATMs Return, Gangnam Style

- First, gold plus ATM is a great story. Bubblegum for the brain, yes, and not actually an important trend or technology anywhere in reality. But I mean, gold out of a vending machine? What click-seeking news editor wouldn't love that?

- Second, gold gets such little coverage most of the time...especially in the West...that journalists and financial editors can sometimes display the collective memory of a goldfish. Besides, who cares if the story is nonsense, whether for the first or 10th time? Just count those clicks and resulting advert impressions!

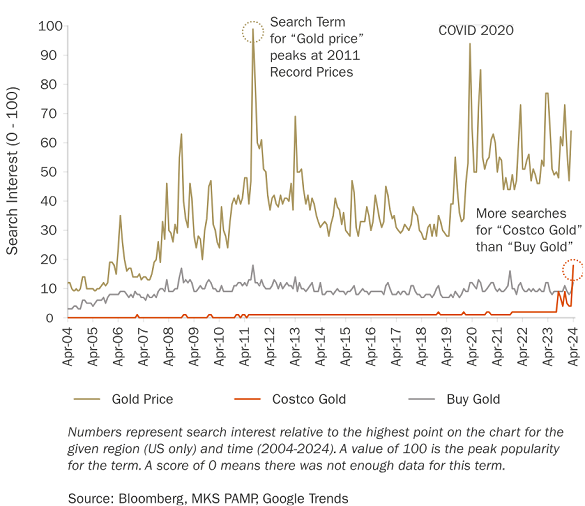

- Third, and in the first-half of 2024 specifically, the price of gold has surged to new record highs. Something must explain it. And besides, clicks!

Email us

Email us